SOL Price Prediction: Bullish Outlook Supported by Technical Strength and Ecosystem Growth

#SOL

- Technical Strength: Trading above key moving average with improving momentum indicators

- Ecosystem Development: Alpenglow upgrade enhances network performance and scalability

- Institutional Adoption: Galaxy Digital's tokenization initiative demonstrates growing institutional confidence in Solana

SOL Price Prediction

Technical Analysis: SOL Shows Bullish Momentum Above Key Moving Average

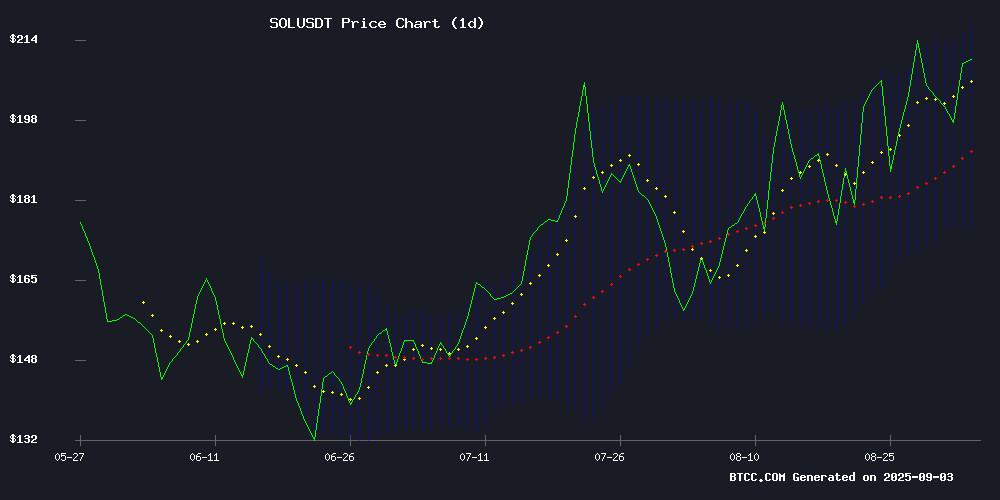

SOL is currently trading at $210.15, significantly above its 20-day moving average of $196.52, indicating strong bullish momentum. The MACD reading of -10.78 remains in negative territory but shows improving momentum with the histogram at -2.21. The price is trading NEAR the upper Bollinger Band at $217.64, suggesting potential resistance ahead. According to BTCC financial analyst James, 'SOL's position above the moving average combined with narrowing Bollinger Bands suggests consolidation with upward bias. The key resistance to watch is the $217 level.'

Positive Market Sentiment Driven by Ecosystem Developments and Institutional Adoption

Recent developments including the Alpenglow upgrade approval and Galaxy Digital's partnership with Superstate to tokenize shares on solana have created strong positive sentiment. The 6.5% price jump following validator approval of network upgrades demonstrates market responsiveness to fundamental improvements. BTCC financial analyst James notes, 'The combination of technical upgrades and institutional adoption through tokenization initiatives provides strong fundamental support for SOL's current price levels. These developments enhance Solana's utility and institutional credibility.'

Factors Influencing SOL's Price

Kamino Protocol Slashes Liquidation Penalties in Response to Jupiter Lend's Market Surge

Kamino, Solana's leading lending protocol, has aggressively reduced liquidation penalties by 90%—from 1% to 0.1%—in a direct response to the rapid ascent of competitor Jupiter Lend. The move, effective September 1, 2025, underscores the intensifying battle for dominance in Solana's DeFi lending market.

Jupiter Lend's innovative liquidation system and lower fees have captured 13.56% market share within weeks of launch, forcing Kamino to recalibrate its approach. The protocol also adjusted its unwinding process, implementing smaller 10% liquidation increments to mitigate borrower risk during market volatility.

This competitive dynamic signals a maturation of Solana's DeFi ecosystem, where user-friendly features now dictate protocol success. Kamino's defensive maneuver reflects the sector's shift toward borrower-centric models, with liquidation terms emerging as a key battleground.

Galaxy Digital Partners With Superstate to Tokenize GLXY Stock on Solana

Galaxy Digital has forged a groundbreaking partnership with Superstate to tokenize its GLXY stock, marking the first instance of a public company directly converting SEC-registered equity into blockchain-based tokens. The collaboration leverages Solana's blockchain for its speed and transparency while maintaining full regulatory compliance.

Shareholders can now convert and manage their holdings through Superstate's Opening Bell platform, with each token representing actual Class A Common Stock. Unlike synthetic alternatives, this model ensures real-time ownership updates on-chain while preserving all traditional shareholder rights.

The move signals growing institutional convergence between traditional finance and blockchain infrastructure. "This isn't just about digitizing shares—it's about unlocking liquidity and accessibility without compromising regulatory standing," said Galaxy Digital CEO Mike Novogratz in a statement accompanying the announcement.

Galaxy Digital Tokenizes Shares on Solana via Superstate Partnership

Galaxy Digital (GLXY), a Nasdaq-listed digital asset investment firm, is pioneering equity tokenization by issuing its Class A common stock as blockchain-based tokens on Solana. The collaboration with Superstate's Opening Bell platform enables on-chain share transfers while maintaining full SEC-registered equity rights—a structural advantage over synthetic alternatives.

The move accelerates Wall Street's embrace of tokenized traditional assets, following recent EU-focused offerings from Robinhood, Gemini, and Kraken-backed xStocks. Galaxy's direct issuer involvement contrasts with wrapped token models, leveraging Superstate as a transfer agent for real-time shareholder registry updates.

Solana's blockchain infrastructure provides the technical backbone for this hybrid solution, combining regulatory compliance with 24/7 settlement capabilities. "This represents institutional-grade validation of blockchain's role in capital markets," noted an industry observer, highlighting the project's potential to bridge TradFi and decentralized finance.

Solana Passes Alpenglow Upgrade Proposal to Enhance Network Performance

Solana validators have overwhelmingly approved the Alpenglow upgrade, with 98.94% support, signaling strong community consensus. The proposal, SIMD-0326, aims to significantly boost network speed and efficiency by overhauling the blockchain's consensus mechanism.

Over 206 trillion tokens were cast in favor of the upgrade, reflecting robust participation. Alpenglow replaces Solana's existing Proof-of-History and TowerBFT protocols with a streamlined system designed to accelerate block finality and reduce congestion during peak demand.

The upgrade's technical improvements focus on minimizing validator communication overhead, a critical step in Solana's quest to maintain its position as a high-performance blockchain. Market observers view this as a strategic move to solidify Solana's competitive edge in scalability and transaction throughput.

Solana Validators Approve Alpenglow Upgrade, SOL Price Jumps 6.5%

Solana's validator community has overwhelmingly approved the Alpenglow upgrade, with 98.27% voting in favor. The upgrade, which replaces TowerBFT and Proof-of-History with Votor and Rotor systems, slashes transaction finality from 12.8 seconds to 100-150 milliseconds—a technical leap that propelled SOL's price 6.5% to $209.

The market response was immediate and decisive. SOL outperformed both Bitcoin and Ethereum on the news, with analysts projecting $215 by late September and $250 by year-end. Whale accumulation is evident, with $14.06 million in net inflows recorded on September 2.

This governance milestone exceeded the 33% quorum requirement, demonstrating strong network consensus. The upgrade positions Solana as a leader in blockchain speed, potentially reshaping competitive dynamics in smart contract platforms.

Solana Price Breaks $209 Amid ETF Optimism and Network Upgrades

Solana's price surged to $209.77, marking a 3.48% gain in 24 hours as market capitalization hit $113.49 billion. Trading volume spiked 35.96% to $9.08 billion, fueled by growing anticipation of U.S. spot Solana ETF approvals. VanEck and Franklin Templeton have updated filings to include staking features, with analysts pricing in a 95% approval likelihood by October 2025.

The Alpenglow upgrade, approved by 99% of validators, will slash transaction finality from 12.8 seconds to 150 milliseconds—putting Solana's speed on par with Google searches. This technical leap strengthens its position as a high-performance blockchain contender.

DeFi liquidity on Solana reached $11.66 billion, the highest in two years, signaling robust capital inflows into lending protocols and decentralized exchanges. The TVL surge mirrors SOL's price rally, confirming fundamental growth alongside bullish sentiment.

Is SOL a good investment?

Based on current technical indicators and fundamental developments, SOL presents a compelling investment opportunity. The price trading above the 20-day MA at $196.52 indicates underlying strength, while recent ecosystem developments provide solid fundamental support.

| Indicator | Current Value | Signal |

|---|---|---|

| Price | $210.15 | Bullish |

| 20-day MA | $196.52 | Support Level |

| Upper Bollinger | $217.64 | Resistance |

| MACD | -10.78 | Improving |

BTCC financial analyst James suggests that while short-term resistance near $217 may cause consolidation, the overall trend remains positive given the network upgrades and growing institutional adoption.